1. I have lost all my love and affection for my wife. I plan to leave nothing to her without even mentioning her name in my Will. Can I do that?

Generally speaking, every person has "free testamentary capacity", which means that people can, by Will, leave their assets to whomever they wish.

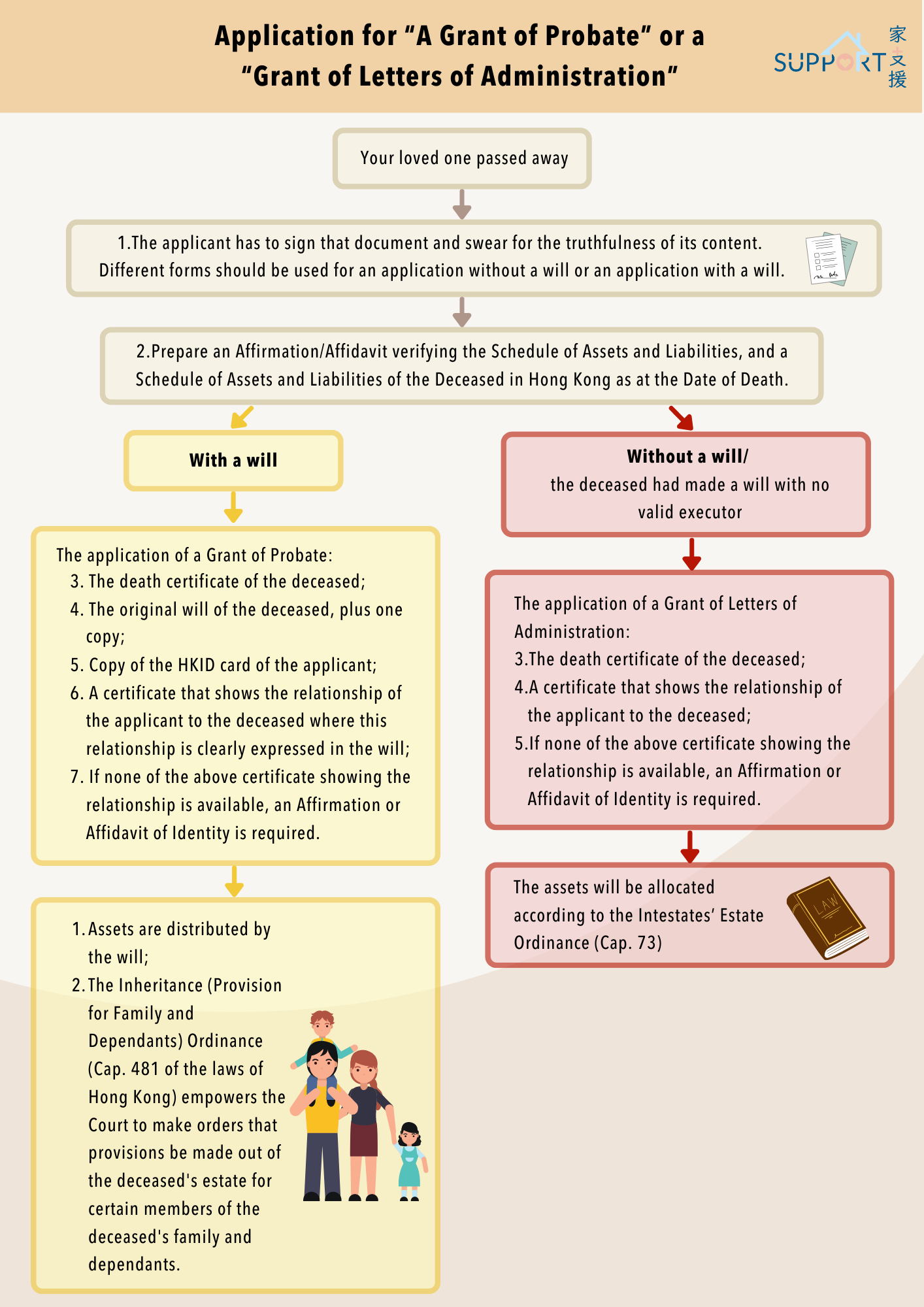

However, the Inheritance (Provision for Family and Dependants) Ordinance (Cap. 481 of the laws of Hong Kong) empowers the Court to make orders that provisions be made from the deceased's estate for certain members of the deceased's family and dependants.

For example, if one was to declare that all their estate goes to their parents, or a charity, without leaving even one dollar to their wife or minor children, such an intention may not be achieved after death. Their wife and children could apply to the Court for provisions to be made for them from their estate. In other words, they may be entitled to get a reasonable amount from the estate in order to maintain their living.

2. Under what circumstances can a Will be revoked?

Usually, a person has to take action to revoke his/her own Will. For example, this might be done by making a new Will or tearing the existing Will into pieces. A circumstance that is often overlooked is the revocation of a Will by the normal operation of law due to a subsequent marriage (a marriage that occurred after the Will was made). A marriage after the execution of a Will automatically revokes the Will unless it is proved that the Will was drafted in contemplation of that marriage. For example, a clause is inserted in the Will stating that the subsequent marriage with a named person shall not revoke the Will. One’s Will would generally be cancelled automatically according to the change of their marriage status. A new Will may be needed to set up.

3. The daughter is mainly responsible for supporting and caring for the deceased, but it is not stated in the Will that the assets will be distributed to her. Can she appeal for the assets?

The act of supporting and caring for the deceased does not constitute a reason for inheritance. If the testator does not specify the distribution of the estate to the daughter, his estate will be distributed according to the contents of the Will.